Pros and Cons of Condominium Living

Written By Dustin Harpe

Are you interested in buying a condo? If so, you’ve come to the right place. Buying a condo is somewhat like buying a single-family house, but there are some differences you should be aware of. There are many pros and some cons to buying a condo and it’s important to be fully aware of every angle before making a decision. So, if you or someone you know is looking to make a condo their new home, read on for much more information.

What is a Condo?

Before we go any further, it’s important to discuss what a condo actually is. A condo is different from a single-family house. While both are single-family residences, a single-family house is likely a standalone building, whereas a condo is typically part of a larger building (2 or more) shared with other residents. But condos are different from apartments.

In simplistic terms, think of a condo as an apartment you own. In those instances, residents often share walls with their next-door neighbors. Condos have common areas like many apartment complexes, but with a condo, the common areas are jointly owned by other condo residents.

It should be noted that there are some condos that are detached single family units.

Are Condos Worth Buying?

It depends on what you’re looking for.

Given the housing market or area of town where you’re looking to purchase a home, condos may be the most popular and prevalent option. In downtown areas, for example, condos are a common choice. Most downtown areas don’t have single-family houses next to office buildings and shops, but condo buildings are often mixed in with these convenient urban amenities.

Condos offer many buyers an opportunity to live in a location they might not otherwise be able to without sacrificing convenience or their preferred lifestyle in favor of homeownership. Owning a condo can be a viable alternative to renting an apartment, especially considering that as a condo owner, you can build equity and often take advantage of tax deductions on the mortgage interest.

Another unique feature of condo living is that most condos will have a governing board that oversees how the condominium community operates and is maintained. These associations manage the complex and handle any rules or guidelines for the community. They are also responsible for the upkeep of the common areas that are owned by all the residents of the building.

Is It Better to Buy a House or a Condo?

If you’re ready to buy a property, the decision to purchase a condo vs. house is a big one. There are many reasons a person might buy a condo instead of a typical single-family house.

Condos can be less expensive than a single-family house, as condos tend to be smaller. Additionally, unlike houses, condos don’t come with any land. Each of those typically makes condos a less expensive option.

Condos tend to be popular for first-time homebuyers due to their affordability, and among retired people, as a condo community will often provide services specifically catered to them. Condo communities typically take care of all outside maintenance including but not limited to lawn/landscaping and snow plowing.

Maintaining a single-family home generally requires more upkeep than a condo, like yardwork or other maintenance. Condos have the advantage of reducing your personal responsibility to your space, freeing up your time. In addition, owning a condo can reduce costs since expenses are shared.

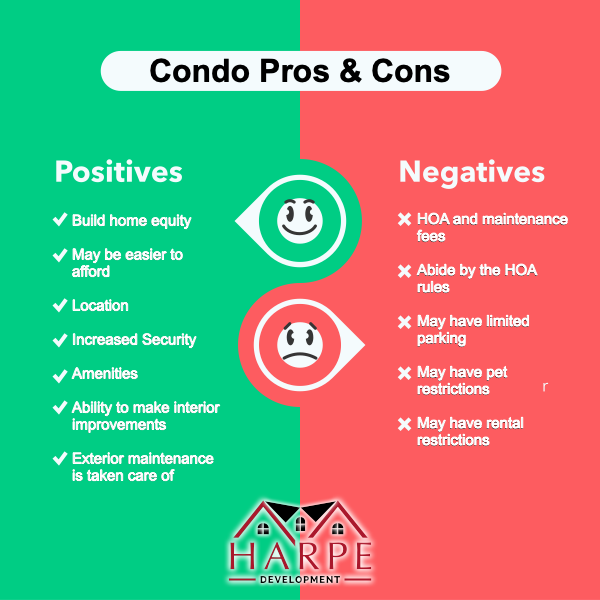

There are other benefits to buying a condo as well. With that in mind, let’s take a look at the pros and cons of buying a condo.

Pros of Buying a Condo

Equity

If you are partial to apartment living due to the amenities and the sense of community you can build, but you are also interested in building for your financial future, condo life may be the right choice for you. When you buy a condo, you can build equity. Home equity is the financial portion of the home the owner truly owns. Equity can increase over time as you pay down your mortgage. Equity can also increase if the property value rises. Then, if you decide to sell the condo, you can use the equity you’ve built to help you buy your new home.

Affordability

Condos tend to be less expensive than their single-family house counterparts, and they can provide homeownership opportunities for more buyers.

Location

Many condos are built in popular, high-demand areas and downtowns, so if you want to be in the heart of a city or within walking distance to many different amenities, a condo might be a good option.

Security

Living among a group of neighbors can provide a sense of security when you are away from your condo. Some communities may be gated and or offer security guards.

Improvements

Unlike an apartment, if you own a condo, it’s yours. You can make home improvements you like to the inside of your unit. Want to redo the kitchen or a bathroom? You can do it. Want to paint a bedroom? You can do it. You aren’t beholden to whether the apartment management company wants to make improvements or not.

Maintenance

With a condominium, you have the benefit of calling someone else when exterior (siding, roofing, driveway etc.) things fall apart. Score! Of course, you’ll pay maintenance fees for this glorious service, but why not? “The condo association takes care of shoveling, snowplowing, landscaping, roofs, painting the exterior, paving, and more — all of those things that can drain your budget and your time on a house

Amenities

As a condo owner, you are co-owner of any common areas that the condo building has to offer. Many communities have clubhouses with gaming areas, work out rooms and pools.

Condominium Association Rules (Pro & Possible Con)

Condo or homeowners’ associations may keep your neighbors from painting their balcony pink, or from allowing your upstairs neighbors to play loud music after 11 p.m., both of which can be welcome when you’re living in close proximity to other people.

Possible Cons of Buying a Condo

No Land Ownership

When you buy a condo, you won’t own the land beneath it. Instead, you share an interest in it with the other condominium residents. When you buy a house, you are also buying the land the house sits on. Depending on your preference, this might mean spending less over time on home maintenance.

Fees

The common areas of a condo building are certainly nice, but it costs money to maintain them. As a condominium resident, you will likely be required to pay a monthly fee that goes towards the maintenance and repair of the common areas. There may also be an additional fee tacked on for any larger repairs and renovations to those areas as well, but you will also get to enjoy these amenity upgrades.

Condominium Association Rules

Since you’ll be living in a community with a community board or association that helps to govern it, you will have to abide by the rules of the condo. Rules may include whether you can have pets, what types of pets you may have, how and when the shared facilities may be used, what can be placed or planted outside, and rules about visitors or guests among others. You may also elect to participate in your community board or association.

Parking

Depending on the location, a condo may come with limited (if any) parking options. Some condos only allow one assigned parking space per unit, which could be an issue if your family has more than one car. Most of our condo developments will have two or three parking spaces available in the driveway depending on what the garage size is.

Is Owning a Condo Worth It?

Whether you want a single-family house or condo is really up to each person or family individually. There are benefits for each one, but condos are definitely an appealing option for first-time homebuyers as condos will help them build equity that they can use to buy their next home. Retirees may enjoy having all exterior maintenance taken care of. Buying a condo may also be the best option available if you want to live in a certain area and buy a piece a property instead of renting.

Given that, let’s take another quick look at the pros and cons of buying a condo:

Condo Loans

When it comes to buying a condo, you should be aware that there are some differences between condos and single-family houses when it comes to the mortgage process.

Compared to a loan for a single-family house, a condo loan may have a few additional considerations.

One big difference between condos and single-family houses is if you choose to get an FHA loan.

If you’re thinking about getting an FHA loan for your condo, it must be listed on HUD’s FHA approved condominium list. The FHA has a list of criteria that a condominium project must meet before it can be approved to allow residents to use FHA financing to purchase or refinance a condo.

If you choose to pursue a Conventional loan, the rules and guidelines will vary from lender to lender as it will depend on their guidelines. In specific cases, lenders may require that at least 50% of the units in the building are owner-occupied as a primary residence or second home. There may also be various HOA-related rules that need to be abided by in the loan, depending on the lender.

If you’re ready to buy a condo, be sure to work with a lender that has experience in condo approvals like Johnson Bank. Use a Mortgage Calculator to find out how much you can afford!